The U.S. Centers for Medicare & Medicaid Services (CMS) is seeking answers from the hospice community — including some around utilization patterns and non-hospice spending.

The recently proposed 2024 hospice payment rule contained a 2.8% reimbursement base-rate increase as well as provisions designed to support program integrity. Further, it included a trove of data and requests for information that could portend future rule making or other actions.

“This proposed rule chock full of very interesting statistics and figures that CMS put out there,” Howard Young, partner at the law firm Morgan Lewis, told Hospice News. “This is somewhat different than prior years where, for instance, it was much more down to the the point of what their proposed rates would be and the like and some focus on health equity. I don’t mean to suggest that there wasn’t an RFI component, but this year, it was a lot of ink.”

Utilization unbalanced

One key set of data pertains to the utilization of continuous home care (CHC), general inpatient care (GIP) and inpatient respite care (IRC).

CMS in 2020 rebased payment rates for the four levels of hospice care in an effort to boost access and better align reimbursement for those services with the costs of providing them. In doing so, the agency expected a corresponding increase in utilization that, to date, has not materialized.

“It was our intent that rebasing these rates would adequately cover the costs of providing these higher-intensity levels of care to ensure that hospices have access to the providers needed to comply with the hospice Conditions of Participation (CoPs), and promote patient access to all levels of care,” CMS indicated in the 2024 proposed rule. “Despite rebasing payment rates for the higher levels of care, there still remains a high percentage of hospices that provide little to no CHC, IRC, or GIP.”

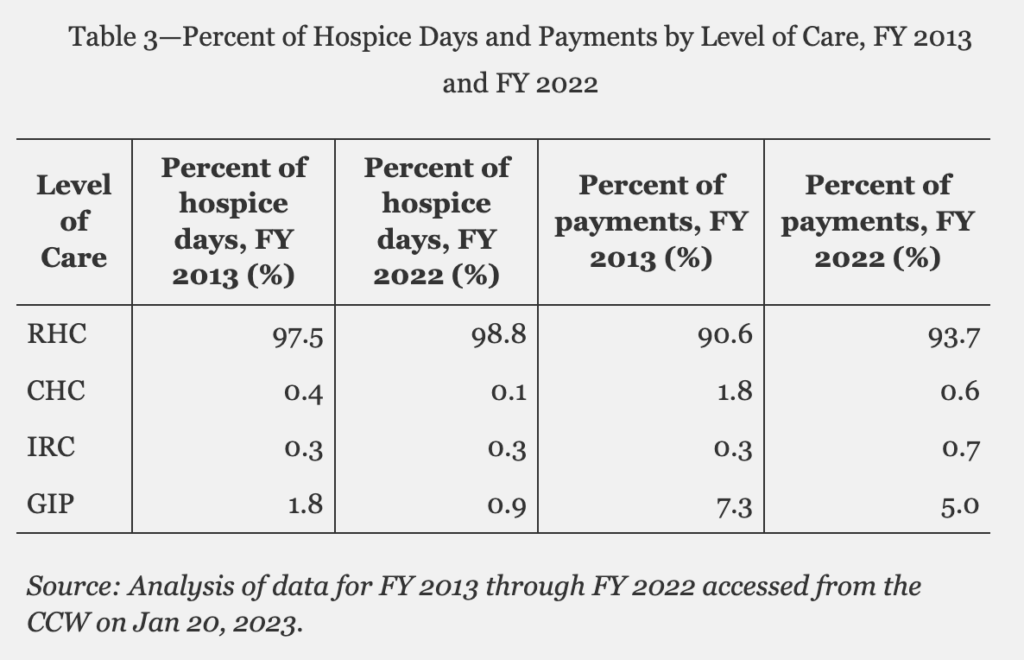

In Fiscal Year 2022, routine home care accounted for 98.8% of hospice days and 93.7% of payments, representing only modest increases from a decade prior.

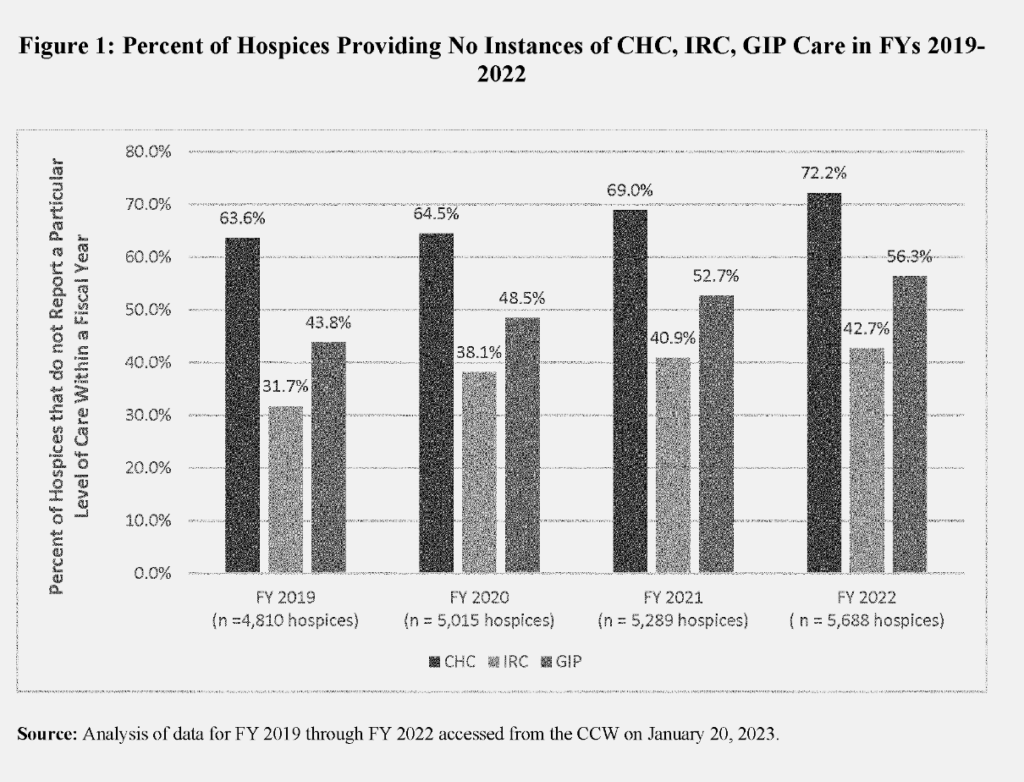

One major contributing factor is that while many hospices offer the three higher acuity levels of care in theory, they do not in actuality, despite federal requirements to do so, according to CMS. As many as 72.2% of hospices did not report instances of CHC last fiscal year, for example.

The agency also noted differences in utilization trends between for-profit and nonprofit hospices. CMS data show that for-profits were less likely to provide GIP in 2022, whereas nonprofits represented the lion’s share of those who did not report instances of CHC.

A number of factors can potentially influence these utilization rates, according to Young.

“One reason may be COVID-19. Getting patients out of their homes into a facility during COVID was especially challenging. I’m not sure they took that into account,” Young said. “The second is just what the effect of audits has been. If you’re a hospice not providing a lot of GIP or not a lot of continuous home care, and then you start providing a lot more — you’re probably putting yourself at much higher risk for being selected for an audit.”

Scrutiny of GIP utilization has been ongoing for a number of years, dating back to 2013 reports from the U.S. Department of Health & Human Services Office of the Inspector General.

Though CMS has no rules that set a limit on GIP length of stay, Medicare Administrative Contractors (MAC) have been pursuing hospice audits related to those that exceed seven days.

These factors may be have a “chilling effect” on those three levels of care, according to Mollie Gurian, vice president of home-based and home- and community-based services policy at LeadingAge.

“CMS needs to help incentivize the use of inpatient hospice, and they can do that by not putting people who deliver GIP in a pay-and-chase situation, which is what they’re in now,” Gurian told Hospice News. “And then CMS tracks them down through their contractors for the claims, which is having a chilling effect. They raise the rates, and then they’re basically asking for the money back by auditing people.”

CMS included extensive requests for information (RFI) in the proposed rule language on a host of issues, including these utilization trends.

For one, the agency wants to know if current enrollment policies complicate patients’ access to CHC, GIP and IRC, as well as whether the associated costs correlate with greater financial risk. CMS has also posed questions about the overall barriers to accessing those care levels, among other requests.

The ‘unrelated care’ conundrum

Additionally CMS also wants to learn more about the factors contributing to rising non-hospice spending for patients who have elected the benefit. That price tag rose in Fiscal Year 2022, exceeding $1.4 billion, the agency reported. This includes items and services covered under Medicare Parts A, B, and D.

The non-hospice Part A and Part B spend in particular rose to $883 million last year, a 28.9% bump from FY 2019. Here, again, trends differ between for-profits and non-profits.

“Beneficiaries receiving hospice services from for-profit hospices had, on average, 60% higher non-hospice spending per day compared to beneficiaries under non-profit hospice care,” CMS indicated in the rule language.

Medicare Conditions of Participation (CoPs) allow health care providers to receive payments for services and items that are considered unrelated to a hospice patient’s terminal illness and associated conditions.

Though allowed, payments outside the Medicare Hospice Benefit should be “exceptional, unusual, and rare,” according to CMS, which historically has taken the stance that essentially all the care needed by a terminally ill patient should be covered through the benefit.

Between 2010 and 2019 Medicare paid a total of $6.6 billion to non-hospice providers for services provided to hospice beneficiaries, according to a report from the U.S. Department of Health & Human Services Office of the Inspector General (OIG).

These rising costs led to a recommendation from OIG that CMS study whether hospice reimbursement reform is needed to address duplicate payments.

Though the vast majority of the time, the hospice is not the organization billing for those services, those practices and the regulatory response impacts them nevertheless. Once again, this often comes in the form of audits.

One issue that complicates the question of which services the benefit should cover is that those determinations are typically left to the hospice’s discretion with little guidance as to what the agency expects.

“There needs to be some clarification and some enforcement around like around these issues. I think that’s probably why they’re putting the data out and why they put the RFI out,” Gurian said. “They want to get at this and I think that some of it is probably new policy, and some of it is clear, clear guidance.”

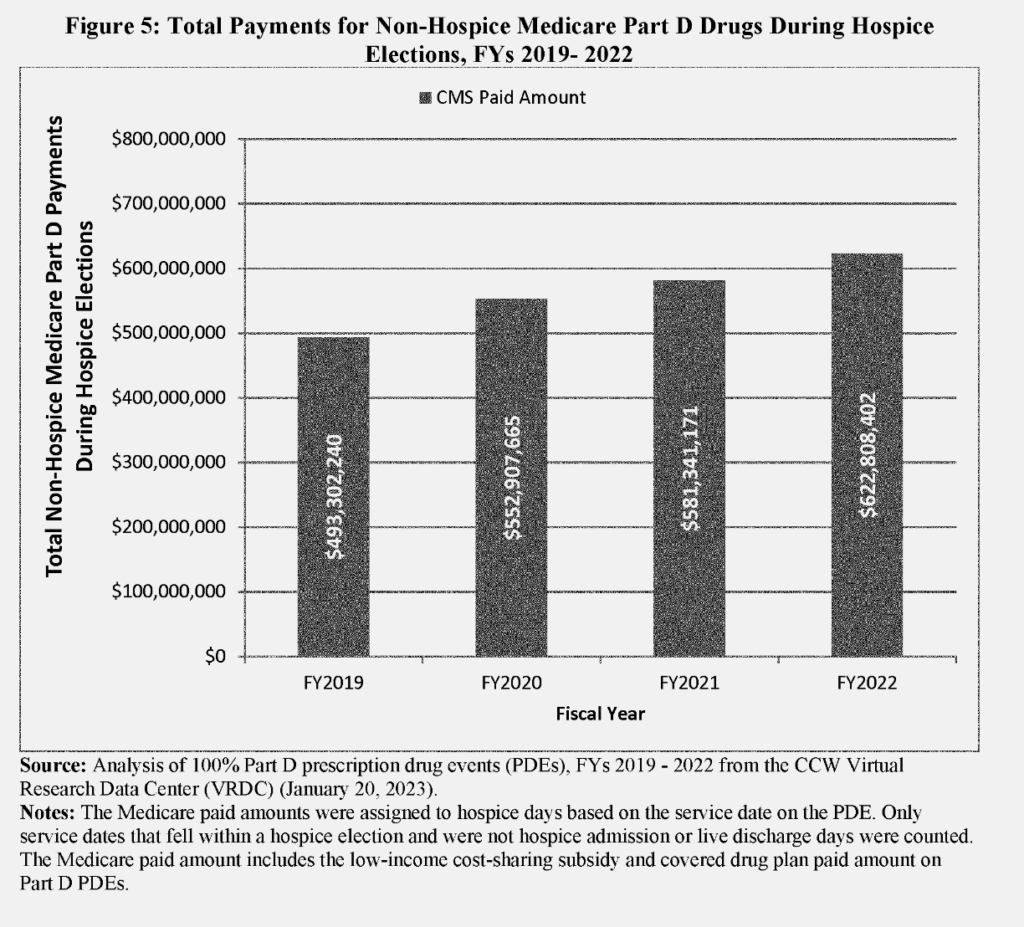

CMS called specific attention to non-hospice-related Part D spending, which rose to $623 million in 2022, up from $493 million in FY 2019. Among the crucial issues are questions around maintenance drugs. For years, CMS and hospice providers have sought to parse out when these drugs should be considered “palliative” versus “curative.”

“They specifically call out maintenance drugs. Sometimes, for example. continuing your diabetes medication can really help you even though that’s not the primary diagnosis,” Katy Barnett, director for home care and hospice operations and policy at LeadingAge. “If that suddenly had prior authorization requirements, there could be an access barrier there. People may say, ‘I’d rather not get on hospice. I don’t want to give that up,’ even though it really does help them at the end of life.”

Further RFIs in the proposal CMS call for additional information from providers on the reasons these non-hospice expenditures occur.

Among its host of questions, the agency queried whether any hospice enrollment policies may be perceived as restrictive to beneficiaries that might need higher-cost end-of-life care, such as blood transfusions, chemotherapy, radiation or dialysis, or those that need “higher intensity” level of hospice care.

CMS also wants know what tools are available to help hospices determine which medications the benefit should cover, as well as how often they are requesting the election statement addendum.

The addendum, which CMS introduced in 2022, adds further wrinkles.

The policy requires hospices to provide families — upon request — a list of any services they receive that would not be covered under the benefit. However, for the time being no data are publicly available regarding how often families make those requests or how often hospices provide them.

The issue here is not merely bureaucratic. Patients and families often accrue out-of-pocket costs for items and services that are considered unrelated to the terminal diagnosis. In aggregate, these costs reached $197 million for Parts A and B services in FY 2022.

As CMS tries to get a handle on these issues, some concerns exist that, in time, this too could trigger audits.

“The fact that CMS is reporting on a lot of the stats asking industry to weigh in,” Young said. “I think it shouldn’t be lost on the sector that there’s a fairly high likelihood we’re going to see increased audit activity in the non-hospice spending as well.”